SowFin Platform

Core Differentiators

Proprietary Analysis Modules

Accurate analysis through specialized finance modules

- Valuation Engine: Automates DCF models and sensitivity analysis

- Comparables Analyzer: Identifies peers and normalizes multiples

- Statement Analyzer: Surfaces trends, anomalies, and red flags

- M&A Synergy Modeler: Quantifies cost and revenue synergies

- Capital Optimizer: Recommends optimal debt-to-equity ratios

Finance-Trained AI Models

Built from the ground up for financial intelligence

- Incorporates finance-specific knowledge

- Understands context like a trained analyst

- Applies rigorous financial reasoning

- Avoids errors typical of off-the-shelf AI models

Investment Intelligence Modules

Purpose-built frameworks for deal evaluation

- Traction Validator

- Red Flags Dashboard

- Target Screening Engine

- Deal Risk Analyzer

- Traction Validator: Assesses product-market fit signals, unit economics, and growth sustainability

- Red Flags Dashboard: Surfaces critical risks across 11 due diligence domains with verification protocols

- Target Screening Engine: Scores acquisition targets across strategic fit, financial health, and integration complexity

- Deal Risk Analyzer: Identifies regulatory, financial, operational, and cultural integration risks

Investment-Grade AI

AI trained on how investors actually think

- Domain Expertise Built-In

- Pattern Recognition

- Contextual Understanding

- Explainable Decisions

- Domain Expertise Built-In: Trained on VC/M&A best practices, not generic business analysis

- Pattern Recognition: Identifies success patterns and failure signals across thousands of historical deals

- Contextual Understanding: Interprets financials, market dynamics, and qualitative factors like an experienced investor

- Explainable Decisions: Every assessment includes reasoning and supporting evidence, not black-box scores

Workflow Acceleration

From weeks of manual work to hours of automated intelligence

- Deal Screening

- Due Diligence Automation

- Investment Memos

- Deal Scoring & Ranking

- Deal Screening: Evaluate 100+ opportunities in the time it takes to manually assess 5

- Due Diligence Automation: Compress 40-hour diligence cycles into 8 hours with comprehensive assessments

- Investment Memos: Auto-generate IC-ready materials with financial analysis, risk assessment, and recommendations

- Deal Scoring & Ranking: Automatically score and rank opportunities across your pipeline based on customizable investment criteria

Enterprise-Grade Security

Built for confidential deal data

- Zero-Trust Architecture

- Granular Access Controls

- AI Guardrails

- Security Observability

- Zero-Trust Architecture: End-to-end encryption with secure AI processing—your deal data never leaves your control

- Granular Access Controls: Role-based permissions for deal teams, partners, and limited partners

- AI Guardrails: Prevents data leakage, prompt injection attacks, and unauthorized information exposure

- Security Observability: Real-time monitoring and logging of all system activities, AI decisions, and data access for full transparency

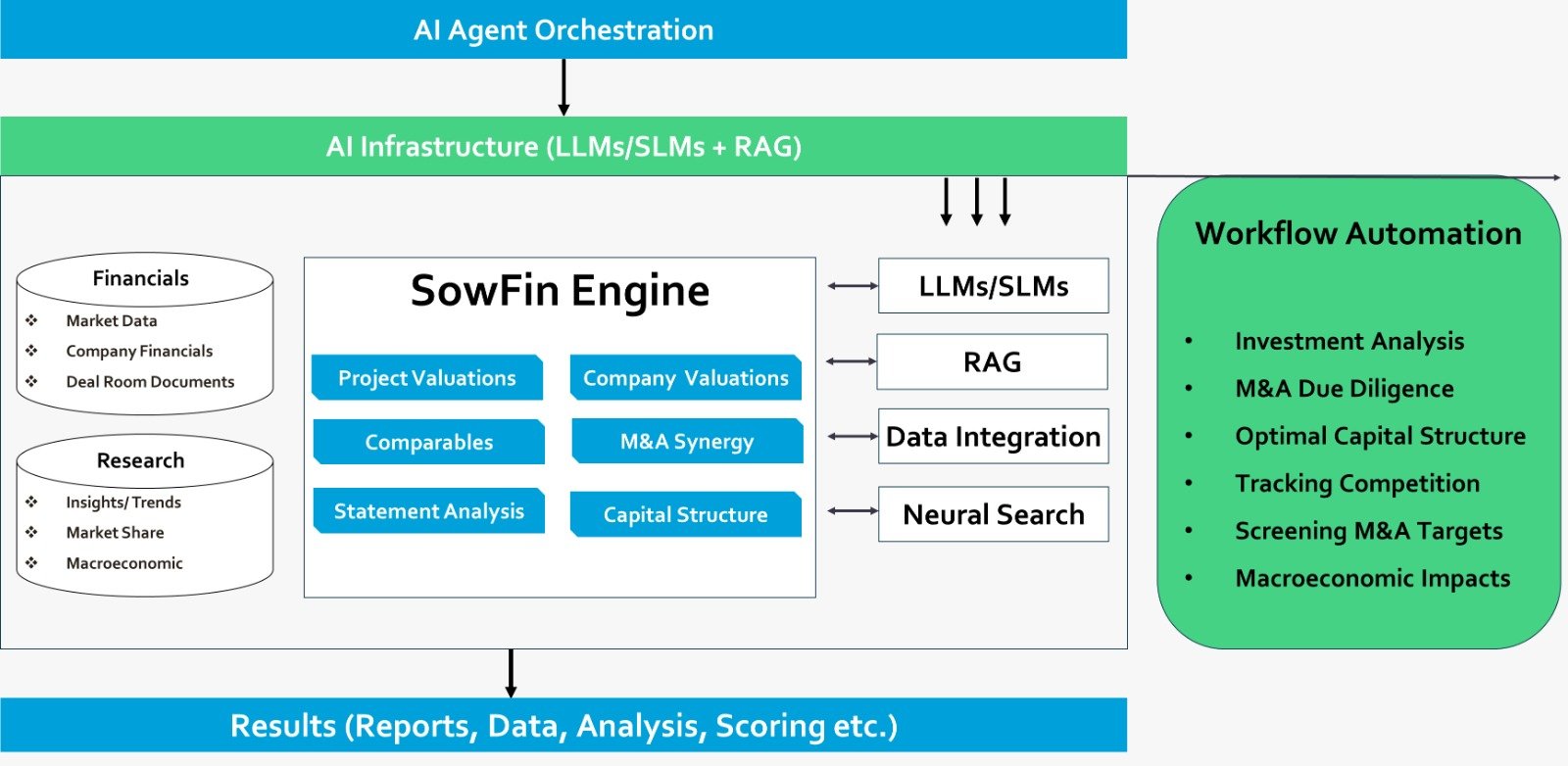

AI Agent-Driven Workflow Automation

Automate and streamline complex workflows

- Deliver dynamic valuations in response to market shifts

- Speed up M&A and investment due diligence

- Optimize payouts and capital deployment

- Proactive monitoring and competitive intelligence

Enterprise Security

- AI guardrails prevent data leaks and prompt manipulation

- End-to-end encryption with zero-trust architecture

- Role-based access controls with fine-grained permission management

- Full audit trails and activity tracking

AI-Powered Financial Intelligence

Empowering corporate finance professionals with AI tools that transform the quality and speed of investment, financing, and payout decisions.

Quality

Eliminate data integrity issues at the source.

Proprietary analysis modules connect directly with financial systems, ensuring valuations, multiples analyses, and financial statements are built on validated, normalized data without manual intervention.

Speed

From days of modeling to minutes of insight

Purpose-built modules for valuations, multiples, statement analysis, M&A synergy, and capital structure optimization execute in parallel, delivering rapid results when market opportunities arise.

Insights

Uncover hidden value creation opportunities

Finance-trained AI models analyze patterns across valuations, statements, and market comparables to surface strategic insights that drive superior investment and financing decisions.

Learning

Build institutional financial intelligence

AI agents continuously monitor projections and recommendations against outcomes, creating a knowledge feedback loop that improves decision quality and accuracy over time.

Collaboration

Seamless workflows across all stakeholders

Intelligent workflow automation routes analyses and approvals to the right stakeholders at the right time, eliminating bottlenecks in complex financial processes.

Automation

Elevate finance professionals to strategic leadership

Specialized analysis modules automate technical aspects of corporate finance, freeing professionals to focus on strategic interpretation and transforming finance into a value creation driver.

FAQs

What does SOWFIN do?

SOWFIN is an AI-powered platform for venture capital and M&A professionals. We automate complex investment workflows like deal screening, due diligence, risk assessment, and investment analysis using specialized AI agents trained on institutional investment frameworks. Our platform reduces due diligence time by up to 80%, helping VCs and M&A teams evaluate more opportunities, identify critical risks earlier, and make investment decisions with greater confidence.

How is this different from a finance chatbot or plugin?

SOWFIN is not a general-purpose chatbot. We use agentic workflows – predefined, finance-specific processes – that ingest structured data, apply corporate finance models, and return outputs in structured formats. Our agents operate with logic and structure, not freeform generation. SOWFIN stands apart by delivering an enterprise grade AI-powered solution that combines robust analysis modules and advanced automation capabilities.

Is this a replacement for Excel or analysts? How does it impact the role of finance professionals?

No. SOWFIN enhances the corporate finance workflows by reducing manual analysis – especially where Excel is disconnected or time-consuming. SOWFIN’s AI-powered platform is designed to enhance – not replace – the work of financial professionals. By automating tasks and accelerating complex analysis, SOWFIN provides teams with the space to focus on high-value, strategic decision-making. Rather than eliminating roles, it empowers finance teams to do more with greater precision, creativity, and impact. AI becomes a partner that amplifies human insight and judgment, not a substitute for it.

How accurate are the outputs?

The system is designed for accuracy and auditability. We apply deterministic financial logic using structured data – not probabilistic answers. We also support context retrieval to improve factual grounding.

How customizable are the AI agents?

Each agent is pre-built for a specific workflow. Users can adjust model parameters, update assumptions, or tailor inputs – but the core process is structured to preserve accuracy.

Is this safe for enterprise use?

Yes. Security is foundational to SOWFIN. Our platform is built with enterprise-grade security architecture to ensure the privacy and protection of sensitive data.

Do you retain or train on customer data?

No. SOWFIN uses a zero-retention policy: no customer inputs are stored or used to improve the model. Each session is ephemeral and governed by enterprise-grade privacy controls.

How do you prevent model errors or hallucinations?

We rely on structured workflows, not open-ended generation. Each agent executes a logic-based process using retrieved data and validated inputs. The architecture includes safeguards like prompt filtering, response validation, and model fallback when uncertainty is detected.

Who is this built for?

SOWFIN is purpose-built for two profiles:

- Venture capital & Angel investors

- M&A deal teams

What pain points does it solve?

- Too much time spent on manual modeling and repetitive analysis

- Lack of integration across data sources

- Limited insight generation due to tool constraints

- Difficulty scaling strategic finance workflows without large headcount

What’s the pricing model?

We offer SaaS-based licensing with use-case-specific tiers, tailored to enterprise finance teams and deal teams. Pricing reflects the depth of workflow automation and integration support required.

How do you compare with consulting firms or outsourced modeling?

We enable internal teams to run complex analysis faster, with higher confidence and lower cost. Consulting is time-consuming and expensive. SowFin delivers repeatable workflows at a fraction of the time without compromising accuracy or governance.

What’s your long-term vision?

Our goal is to become a trusted AI partner for corporate finance. Over time, we’re expanding our agent library to cover more strategic workflows. We’re building toward a future where finance teams run high-confidence analysis at scale: securely, quickly, and with full transparency.

How do you ensure responsible AI use?

Responsible AI is a core value. We’ve embedded safeguards at every level: from input validation and model observability to copyright safety and data governance. We focus on transparency, control, and explainability in everything we build.